Content

- “No Kings” protest within the Chicago Monday: What you should understand the brand new anti-Trump rally

- What to discover when searching for one of the best banks within the Chicago?

- Perfect for a classic Bank Feel: Huntington Lender Asterisk-100 percent free Examining

- Lesser replacement Airbnb inside the Chicago

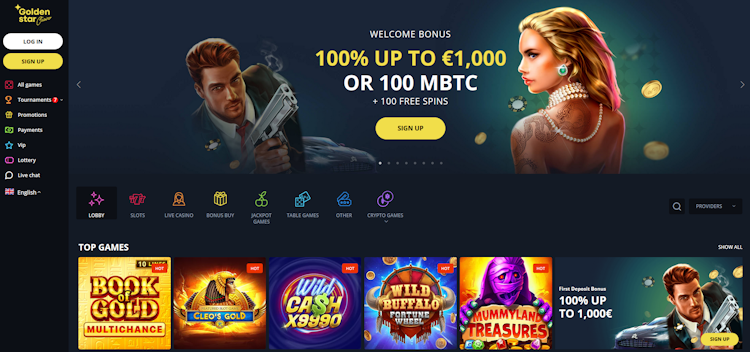

Stand Benefits is a new an element of the StayProtection exposure and this does not include all of the Flatio living spaces. It were liability insurance, casino 777spinslot review assistant functions, and you will twenty-four/7 on the web support for everybody issues covered by this. StayProtection to have Traffic is a Flatio coverage you to definitely applies to you at all times. It absolutely was made to protect you, your finances, and your reassurance. StayProtection also contains a personal Circulate-inside Ensure, making sure you have accommodations even though something never go because the prepared. Here are the left CIT membership alternatives if you’lso are interested in exactly what otherwise you might take advantage of.

Charles Schwab Bank is just one of the finest banks to possess around the world traffic, because does not fees foreign exchange charges. But when you need to earn highest interest rates, you’re better off lookin in other places. Merely safeguarded credit cards require an excellent refundable protection put.

- We’ve gathered an extensive set of Illinois financial institutions and you can credit unions that allow you to definitely unlock a bank account, no matter what its banking records.

- The examining accounts, called show accounts, come with individuals perks, as well as 100 percent free expenses spend, on the internet and mobile financial, email notification, and remote put.

- LetMeBank does not be sure any device, recommend specific offers, or give elite group judge otherwise monetary information.

- Just after one year from maintaining a positive equilibrium, players is also change to a fundamental checking account.

Opinions expressed listed below are blogger’s alone, not the ones from the bank advertiser, and possess perhaps not already been assessed, acknowledged if not endorsed by the bank advertiser. This site can be settled from lender marketer Representative Program. Make sure that the financial institution that you choose have ATMs otherwise a branch nearby the towns visit appear to. Your don’t have the choice from operating in order to a branch and you may talking so you can someone face to face.

“No Kings” protest within the Chicago Monday: What you should understand the brand new anti-Trump rally

Furthermore, mid-identity stays for rental render a level of comfort and you can benefits that’s tend to without antique rentals. Out of home appliances and you can utensils in order to bedding and toiletries, everything is provided to make sure a soft and you can problems-100 percent free stand. When you are Chase might not offer the best interest rates in town, its tiered program ensures you could potentially optimize your earnings by connecting accounts otherwise bolstering what you owe. Talk about the new 120-month Video game to own an APY one to is superior to the newest step 1% draw.

They essentially guarantees a comprehensive and you can varied assessment of your own Video game prices open to savers and you will buyers. In the Illinois, Woodforest Federal Lender has branches inside the towns for example Aurora, Bloomington, Champaign, Decatur, Joliet, Peoria, Rockford, Springfield, and a lot more. U.S. Team Borrowing Connection provides twigs within the Hines and two towns inside Chicago. GN Financial, previously Illinois Service Government, allows someone to unlock a merchant account when the here’s zero scam record without a good debt to GN. Hegewisch has part metropolitan areas inside the Chicago, Calumet Urban area, Frankfort, Homewood, Lansing, Lynwood, Oak Tree, and you may Tinley Playground. Immediately after properly maintaining the fresh make up 12 months, you could potentially upgrade so you can possibly 100 percent free Checking or Large Give Examining, enabling more freedom.

Which prevalent Atm community assurances accessibility to have people, therefore it is a favorable choice for of many. Of numerous people are familiar with the most significant banking companies, but credit unions should also be sensed. Participants could see winnings returned thanks to diminished costs, high savings, and you may lower credit cost. When you’ve identified the correct account for your position, end charges by the linking your bank account to a different membership during the debt business. For individuals who overdraw a checking account, the financial institution tend to withdraw funds from additional account to expend the transaction.

What to discover when searching for one of the best banks within the Chicago?

During the CNBC See, the mission should be to offer our very own members with high-high quality services news media and total individual information for them to create informed behavior with their money. The Computer game comment is dependant on rigid revealing because of the we of expert editors and you can editors having extensive expertise in banking and you may savings items. Find the methods for additional info on the way we find the best Cds. Since the majority banking companies offering Cds is FDIC-insured, you simply will not lose money around the new legal limit from $250,000 for every account proprietor.

Of numerous users features recorded issues on the Individual Monetary Shelter Agency, stating that Chime features suddenly closed their profile and regularly leftover him or her of opening their money. You must discover a brokerage account that have Charles Schwab just before opening a bank account. Becoming an associate, spend a single-go out membership percentage and you will unlock the brand new Users Borrowing from the bank Union Membership Express Savings account with no less than $5.

Perfect for a classic Bank Feel: Huntington Lender Asterisk-100 percent free Examining

But not, the fresh membership have to be financed in this 30 days to prevent closing. Addititionally there is a business Savings account provided by no minimal balance otherwise charge. Secure handmade cards generally have straight down borrowing from the bank constraints than just unsecured handmade cards. You need to use a guaranteed card and make requests like most most other charge card, investing up to the borrowing limit. You’re expected to build typical costs and pay at the very least the minimum percentage owed for each and every charging you cycle.

Lesser replacement Airbnb inside the Chicago

The new Federal Deposit Insurance Business talks about all the banking institutions, online and stone-and-mortar, similarly. GOBankingRates bases their assessment out of “best” and you can “top” points on the over-said variables to make set up a baseline to have evaluation. Which evaluation are an enthusiastic approximation of “best” and “top” made to help users find products that would be suitable for them. People should consider some alternatives appropriate for its items. Take CNBC’s the new online way Simple tips to Negotiate increased Income. You need to statement the interest in your taxation come back for membership earning more than $ten in a single seasons.

The content that people do is free of charge and individually-sourced, with no people repaid-to have campaign. In the event the one thing, the financial institution is going to be spending your to your advantage of carrying your bank account. For many who have trouble with tech, working with a brick-and-mortar bank might possibly be a far greater options.

With more than 3 hundred branches and you can eight hundred ATMs peppered round the Chicago and the environments, Chase Bank stands high because the go-in order to economic companion to possess Windy City people. Being able to access the money has never been smoother, whether or not you’re also strolling thanks to downtown or relaxing from the suburbs. Utilize the efficacy of Chase’s member-amicable webpages and you may mobile banking application in order to effortlessly control your account to the fly. Banking companies control currency way between somebody and you will organizations, whether or not bodily organizations or Internet sites of those. Banks offer put account, safer stores rooms for all of us’s bucks.

What facilities you prioritize may vary centered on everything’re always. Set up low balance notice on the lender’s or borrowing partnership’s website or software. Such announcements, which could tend to be Texts messages, inform you if your account is just about to become overdrawn. Security try important, and looking to own banking institutions you to definitely like FDIC-associate financial institutions is very important. Your own places might possibly be insured to $250,100 for every account possession category, per financial. The newest Federal Deposit Insurance policies Corporation (FDIC), another service of your own United states regulators, brings it insurance, providing peace of mind those funds is actually secure.

One of many a few discounts accounts provided by the bank are customized exclusively for students. The new PNC Fundamental Checking account is but one giving the newest really really worth. Even big associations including Chase otherwise Wells Fargo agree with this.