Articles

Arizona (AP) — The brand new Biden government wants to build home-based a home deals a lot more transparent by the unmasking the owners from particular all the-bucks requests. It’s part of a continuing efforts to fight money laundering and you may the brand new direction from dirty money through the Western financial system. Agency of one’s Treasury and you may condition banking authorities to incorporate the subscribers with a safe, safe percentage services. The organization has released the newest ties, funded the money supplies, implemented money laundering identification options, centered OFAC examination, and you can completed the newest financial regulation and you may monetary audits to operate because the a non-bank standard bank.

Starting inside the industrial a home

If you don’t has a bank account, go to Internal revenue service.gov/DirectDeposit to learn more about how to locate a financial otherwise borrowing from the bank connection which can unlock a merchant account on the internet. You could prepare the brand new tax go back on your own, find out if you be eligible for free income tax preparing, otherwise hire a tax top-notch to set up their come back. A blanket withholding certification may be awarded should your transferor carrying the new USRPI provides an enthusiastic irrevocable letter out of credit otherwise a guarantee and you will adopts an income tax commission and you will shelter contract for the Internal revenue service.

Spend money on Solitary-Members of the family Belongings

Inside the a scene where time matters, finding the optimum provider changes what you. A key downside from a REIT would be the fact it will spreading at the very least 90% of the taxable income as the dividends, which limits being able to reinvest winnings for gains. This can constrain enough time-label money enjoy compared to most other holds. An alternative choice to have investing in home-based REITs is to purchase a keen ETF you to spends in the home-based REIT carries.

Another kind of income gotten by the a foreign bodies is actually at the mercy of chapter step three withholding. A shielded expatriate must have provided you that have Form W-8CE notifying you of their shielded expatriate condition and the facts that they’ll getting subject to special income tax legislation in respect to particular things. “Willfully” in cases like this setting voluntarily, consciously, and intentionally. You’re pretending willfully if you shell out almost every other expenditures of your own business instead of the withholding fees. Such, in the event the a confidence will pay wages, for example certain types of retirement benefits, extra unemployment pay, otherwise resigned shell out, plus the individual for which the assistance had been did does not have any courtroom control over the brand new fee of one’s earnings, the new faith ‘s the company.

Industrial assets money is pretty tight and may also need you let you know a confident background that have residential home first, towards the top of happy-gambler.com inspect site placing additional money down. It’s in addition to an excellent riskier funding, as possible more difficult to find clients, and industrial functions may getting affected by bad economic climates. Most people trying to find pupil home using get started with home, and justification. The brand new barrier to help you entryway is gloomier both financially plus conditions of experience peak. Down payments is rather smaller, and you can particular consumers may even be eligible for deposit advice programs you to definitely aren’t readily available for commercial a home. What’s a lot more, it’s generally in an easier way to be eligible for home financing than simply a commercial mortgage.

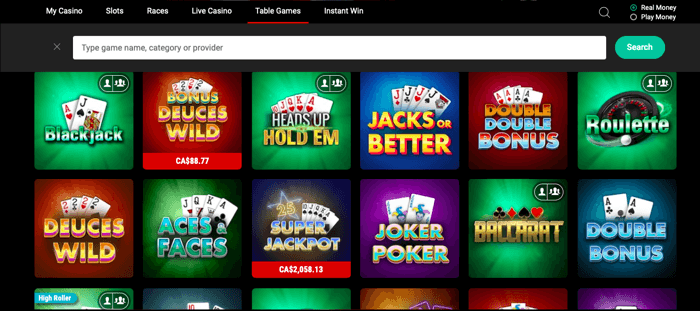

There should be a balance anywhere between what is offered because the a bonus and you will all you have to do in order to change you to extra on the real money. I Number Precisely the Registered OperatorsAll poker internet sites here has started authorized and you may official because of the designated jurisdictions and you will regulators, promising the security, legality, and you may fairness of them websites in addition to their casino poker online game. Also, we check out the reputation for web sites to be sure players are content for the functions offered and you will treatment. Just once we make sure the site presses all the correct packets do we expose they here.

Withholding international partnerships and you may withholding international trusts commonly flow-as a result of agencies. An excellent payer data files a tax get back on the Form 945 so you can declaration copy withholding. A good U.S. relationship would be to withhold whenever people distributions that are included with quantity susceptible to withholding are created. You might turn vacant bed room on your own property for the local rental spaces also known as accessory house systems. Because of the updating your own basement, missing, and other room on the a great livable tool, you could potentially attract rent-using tenants. You additionally can also be build an invitees family while the a keen ADU if you may have sufficient free-space to your assets you currently own.

Genisys Borrowing from the bank Relationship *

Treasury was also responsible for undertaking most other transparency-relevant initiatives, such as the rollout of a new databases to your home business control. The newest therefore-named useful possession registry is expected so you can contain information that is personal for the the owners with a minimum of 32 million You.S. companies. One study on the fresh impression of money laundering to the home prices in the Canada, conducted from the several Canadian teachers, learned that currency laundering financing within the a house pressed up housing cost on the listing of step 3.7% to 7.5%. A property are a commonly used car for money laundering, due to opaque revealing laws on the orders.

Companies in the a property market is always to plan the new implementation of this last code by the examining its newest AML methods, pinpointing opportunities which can cause revealing personal debt, and you may setting up techniques to adhere to the new criteria. FinCEN features provided Frequently asked questions to aid stakeholders browse the fresh rule’s intricacies. Because it’s backed by offline, lead a property in addition to deal quicker prominent-agent dispute or even the extent to which the eye of the buyer is dependant on the new integrity and you can competence away from managers and you will debtors.

However with all the different claims allowing some other workers, anything can get a tiny dirty on the uninitiated poker professionals in the us. Such normal dividend-investing carries, REITs is a solid money to own traders just who find typical earnings. To the as well as top, because the possessions initiate introducing cash, it could be leveraged to get a lot more possessions. Slowly, the brand new investor can acquire plenty of money avenues from numerous features, offsetting unexpected will set you back and you may losings having the new money.

Unsecured Team Loan

The industry struggled in the 2008 economic crisis, then listed REITs replied by paying away from personal debt and re also-equitizing the equilibrium sheets because of the offering inventory for cash. Listed REITs and you will REOCs raised $37.5 billion inside the 91 second guarantee offerings, nine IPOs and 37 personal debt offerings while the investors continued so you can work definitely so you can companies building their equilibrium sheets after the borrowing from the bank crisis. A collaboration try a good “resident” out of Maine in the event the at the least 75% of one’s control of these partnership try kept from the Maine owners.

A You.S. faith must keep back for the matter includible regarding the revenues away from a foreign beneficiary to the the amount the fresh trust’s distributable net gain includes an expense subject to withholding. To your extent a You.S. faith must distribute an amount at the mercy of withholding however, cannot actually dispersed the quantity, it should withhold on the overseas beneficiary’s allocable show during the day the funds is required to getting said for the Setting 1042-S. When the a price at the mercy of section step three withholding is even a withholdable commission and you may section cuatro withholding try placed on the fresh payment, zero withholding becomes necessary below section 3. Sobrato become offering belongings in the Palo Alto because the students in the Santa Clara College or university, sooner or later moving into development industrial features next to his mommy prior to beginning the new Sobrato Company inside the 1979.