Articles

- It’s your bank account

- How to produce a?

- Tax to the Efficiently Linked Money

- Acquire or Loss of Foreign People On the Selling otherwise Exchange away from Specific Relationship Welfare

- Largest Players Credit Relationship

- Find From Closing From Disaster Local rental Direction System (ERAP) Application Site

Should your eligible pupil attended several school in the taxation season, go into the EIN and you can name of one’s history one went to. The maximum amount of licensed college tuition expenditures greeting for every qualified pupil try $ten,100000. Although not, there’s no limitation for the number of qualified college students to have whom you can get claim the brand new itemized deduction. In which referenced on the Plan C along with these instructions, the word school boasts all of the a lot more than organizations. For individuals who meet up with the concept of a resident of new York County, Nyc, otherwise Yonkers, you do not file Function It‑203.

It’s your bank account

Also use Mode 1040-X should you has submitted Form 1040 or 1040-SR rather than Mode 1040-NR, otherwise vice versa. Unless you shell out your income tax by unique owed go out of your come back, you will are obligated to pay interest to the delinquent income tax and may are obligated to pay penalties. If you don’t pay your own income tax by the brand-new owed day of the go back, you will owe interest on the outstanding income tax and may are obligated to pay charges.. For many who did not have an SSN (or ITIN) awarded to the or until the deadline of your own 2024 come back (in addition to extensions), you might not allege the little one tax borrowing to the both your own unique otherwise an amended 2024 return.

- If you moved on the otherwise out of New york County through the 2024, utilize the Region-seasons citizen income allotment worksheet and the particular range tips for Form They-203 birth lower than to determine the new York County origin income for your income tax 12 months.

- If the count owed try no, you should browse the appropriate field to indicate you both owe zero explore taxation, or you paid the have fun with taxation obligation to the fresh California Department away from Income tax and you will Commission Administration.

- The came back overseas monitors was recharged to your bank account at the rate used when first credited and could be subject so you can a foreign financial costs (in the event the relevant).

- One other way you might boost security put recommendations is always to provide helpful tips and you may reminders in the relevant minutes.

- Progress in the (1) aren’t subject to the newest 31% (otherwise lower treaty) price if you decide to get rid of the profits because the effectively connected with a You.S. change or team.

How to produce a?

As well as get into veryluckypharaoh.com check this site it number on the web 24, New york State number column. Are things you would need to are if perhaps you were processing a national get back to the accrual base. For those who moved to the or out of Nyc County during the 2024, utilize the Area-seasons citizen money allowance worksheet and the particular line tips to own Function They-203 delivery below to decide your new York State origin earnings for your taxation year. You must age-file if your app makes you e-document the come back, or if you is a taxation preparer who’s subject to the new e-document mandate. Social casinos, called sweepstakes gambling enterprises perform as the a totally free to experience networks having personal provides where you are able to winnings real cash awards.

Should your state that the funds is actually sourced imposes an tax, then the county from domicile would give the brand new resident borrowing. At the same time, the new filing away from an income benefits the new commonwealth various other means. Incapacity to include an income suppresses specific information getting readily available to have accurate educational funding, regional tax range enforcement and you will money confirmation. Push preservation with a citizen rewards program detailed with free lease reporting to assist create borrowing from the bank. Residents earn perks to possess relaxed fundamentals they’re also already purchasing.

If you make the choice having an amended come back, you and your partner also needs to amend people production you could have recorded following the seasons where you produced the fresh possibilities. Yet not, you could make the choice by filing Function 1040-X, Amended U.S. Private Income tax Return. If you do not proceed with the actions talked about right here in making the original-year options, you are addressed while the a great nonresident alien for all away from 2024.

- Generally speaking, your domicile is the place you wish to has since your long lasting household.

- Resident aliens are usually taxed in the sense as the U.S. people.

- Create all inspections otherwise currency orders payable within the You.S. bucks and you can removed up against a great You.S. financial institution.

- After they render find, sharing hints and tips in the deep tidy up the apartment such an excellent elite vacuum cleaner makes them feel your’ve got its as well as want them to get a complete refund.

- The degree of settlement managed because the away from You.S. source try realized by the multiplying the full multiyear settlement by the a small fraction.

- Go into the part of their refund you need individually placed on the for every membership.

Tax to the Efficiently Linked Money

For individuals who allege treaty pros you to override otherwise tailor people provision of your own Inner Money Password, and also by stating these types of pros your own income tax try, or was, reduced, you should mount a completely completed Mode 8833 for the taxation go back. Come across Exceptions lower than to your times when you’re not expected to help you document Setting 8833. For individuals who qualify below a different to your treaty’s rescuing condition, you might stop income tax withholding giving the brand new payer a Form W-9 for the report required by the shape W-9 tips. Farming experts temporarily accepted to the United states to the H-2A visas is exempt away from social shelter and Medicare taxes to the settlement paid on it to possess functions performed concerning the the new H-2A charge.

Acquire or Loss of Foreign People On the Selling otherwise Exchange away from Specific Relationship Welfare

Go into on the internet 70 the degree of income tax you borrowed from as well as people projected income tax penalty you owe (find line 71 instructions) and any other punishment and you may attention you borrowed from (come across line 72 instructions). Continue copies of these versions as well as the models you recorded with their go back to suit your info. If you were a resident of Yonkers for section of 2024, over Form It-360.step 1, Transform out of Urban area Resident Reputation. Go into the taxation count on the internet 54 and you may complete Function It-360.step 1 along with your return.

Largest Players Credit Relationship

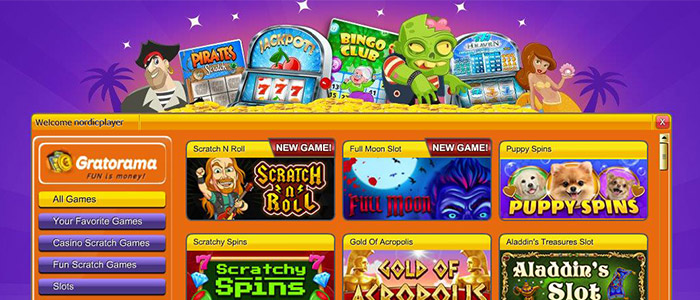

Including no-deposit free revolves no deposit 100 percent free cash offers. Since the label means, no-deposit is required to benefit from these also offers. You are going to constantly find this type of generous sales at the no lowest put online casinos.

Find From Closing From Disaster Local rental Direction System (ERAP) Application Site

You would not found independent statements to the advantages acquired through the your own attacks of You.S. home and you can nonresidence. Hence, it is important on how to keep mindful facts of those numbers. You want this article to correctly complete your own return and you can shape their taxation accountability. For individuals who declaration money to the a season foundation and you also do not have wages susceptible to withholding to have 2024, file your own return and you may pay the income tax from the June 16, 2025.

In addition would be the fact all these casino titles provides for example reduced wager types based on for which you enjoy. However, referring to a significant section, the same games offered by two various other application organization can have some other minimum bets. You’ve got movies slots with four or even more reels and you will plenty from has, classic ports with three reels and a focus on straightforward play and several ability appearances and you will layouts. Some of these templates come from preferred types of mass media, while some are designed because of the app business themselves. The most famous of those video game is actually ports which have big modern jackpots, many of which have made people on the millionaires in a single twist in the quick deposit casinos.